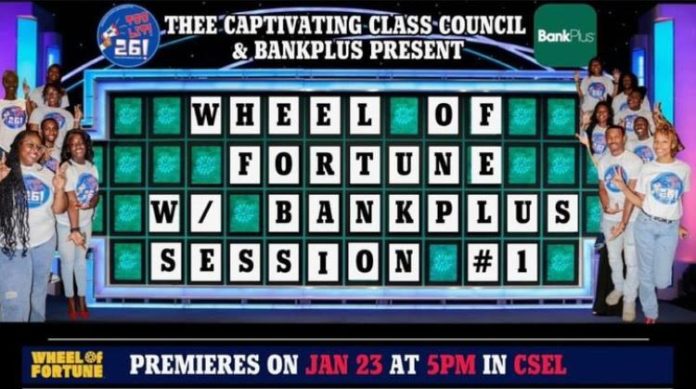

Photo: CSEL

Shakell James

Staff Writer

Thee Captivating Class Council collaborated with BankPlus on to discuss the topics of credit, credit reports, credit scores, and student loans.

The event, which took place on Jan. 23, 2024 in the Student Center. The speakers for this event consisted of Vice President of Community Affairs Officer Ralph Jackson and Community Service Lendor Devasia Spires.

A credit report is a document that displays your borrowing/money management history. Credit reports are free of charge, but do not include your credit score.

A credit score is a three-digit number that summarizes your credit risks. These risks are both negative and positive aspects of your credit.

Tips on what information that will and will not be on a credit report were given during the event.

Information that will appear are personal information, public records, credit accounts, inquiries (requests for your credit report), credit accounts, and optional consumer statements.

What would not be included is a person’s race, gender identity, national origin, political affiliation, race, driving record, and income.

Kaiden Ivey, sophomore vice president and an accounting major from Tulsa, Okla., emphasized the importance of saving to her fellow classmates.

“Some advice I would give students about saving money is making sure you save before you spend. If you cannot buy it twice, don’t buy it at all. You want to make sure that you have enough funds for what is needed, instead of being broke in the end, getting something quick,” Ivey said.

Jackson mentioned that credit analysts look at your history. This is when delinquency comes in. Delinquency represents a failure to pay an outstanding debt.

Information of late payments can stay on your credit report for as long as 7-10 years, and depending on the situation, even longer.

The example Jackson used was buying the new IPhone 15. The IPhone 15 costs around $1500. You have your options of which payment plans, but ultimately you have to pay.

No matter the item or the purchase, it follows you.

Spires discussed student loans and saving as college students. Ignoring student loans can have serious consequences. Your debt increases the more you wait to pay, which affects future purchases.

Small loans being paid back matter just as much as the larger ones.

“One of the biggest things I would say is whatever you’re majoring in is going to have potential yield, or whatever income you would like to make. As far as the student loans, only take out what is absolutely necessary. I wouldn’t encourage taking out more than what you need just to get a refund,” Spires said. “A lot of those funds are actually blown and not necessarily used for the purpose they’re taken or borrowed for. Try your hardest to save 10 percent of your earnings.”

Arianna Dunkin, a sophomore biomedical engineering major from Beloit, Wis., shared her thoughts on the event hosted by the sophomore class.

“I think that the event was very beneficial for people wanting to learn about financial literacy. It really helped me out with knowing how to not be in debt,” Dunkin said.